Beijing jumped to the top position among Asia Pacific metropolitan commercial real estate investment markets for the first time ever, with investments totalling US$4.5bn during the first quarter of 2019.

The Chinese capital leapfrogged to the pole position from seventh place in 2018, thanks to two mega deals worth more US$1.3bn, according to data provider Real Capital Analytics.

“Traditionally, Beijing was considered a government city, more than a major commercial real estate investment target,” said Petra Blazkova, senior director of analytics for Asia Pacific at RCA.

“Cross-border capital flows, however, appear to be changing the nature of the market and the city is becoming more appealing to institutional investors.”

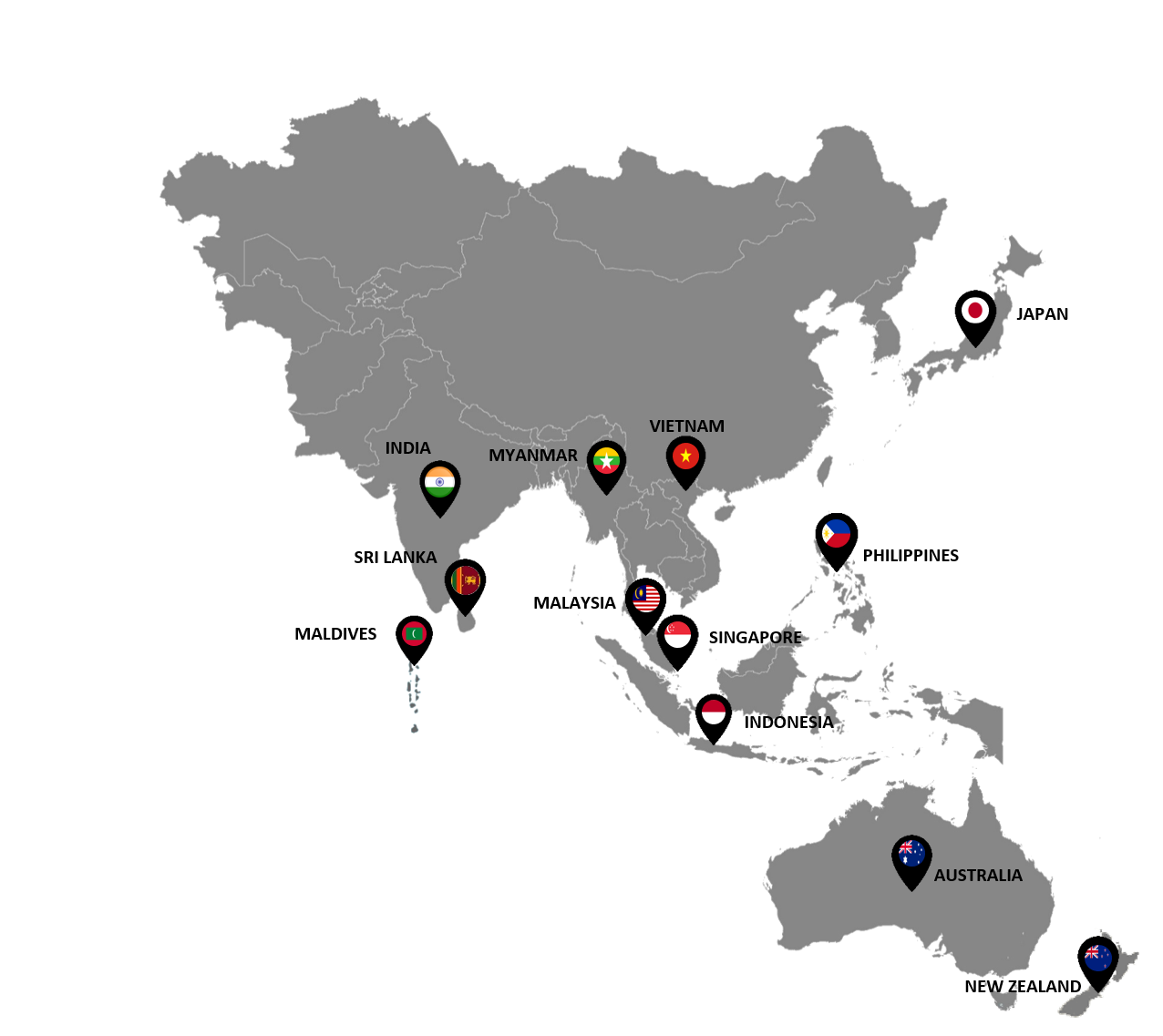

Most Active Metros in Asia Pacific in 1Q19 (image: RCA)

Most Active Metros in Asia Pacific in 1Q19 (image: RCA)

It was a different story for the region though, as Asia Pacific commercial real estate investment slumped 36% to US$30.5bn in 1Q19, compared to the same period the previous year.

The firm said China’s economic slowdown, its trade tensions with the U.S. and the global downturn in demand for consumer products took their toll on property investment across the region.

Blazkova said the markets were comparatively late in the real estate investment cycle and prices looked high from a historical perspective.

“Global interest rates, however, remain relatively low and the count of pending deals is substantial in markets such as Hong Kong, China and India,” she said.

“On balance, these factors signal that the outlook for Asia Pacific’s investment markets for the remainder of the year may be more upbeat.”

In Australia, real estate investment volumes dropped 27% year-on-year to US$3bn, led by a pull-back in cross-border capital flows.

Falling home values in recent years have hurt the country’s housing market, while rising e-commerce is taking its toll on retail, especially discount department stores.

“While the office yield compression in Sydney and Melbourne stopped at or near record lows, more pressure on yields was obvious elsewhere,” the senior director of analytics said.

“The structural changes ahead of the Australian retail sector have started to impact its pricing. Shopping centre yields have moved out by 70 basis points in the last 12 months.”

The slow first quarter result follows a bumper year for the region in 2018, when commercial real estate investments totalled US$159.1bn in Asia Pacific, the second highest on record.