Several regional commercial property markets across Asia Pacific are entering into a period of slower growth, according to the RICS Q2 2019 Asia Pacific Commercial Property Monitor.

Survey respondents shared a more cautious outlook due to economic uncertainty, however still broadly expected rents and capital values to rise over the next 12 months.

Trade concerns weighed on markets in East Asia, with several participants highlighting concerns that commercial property would see blowback from the renewed trade tensions between the US and China.

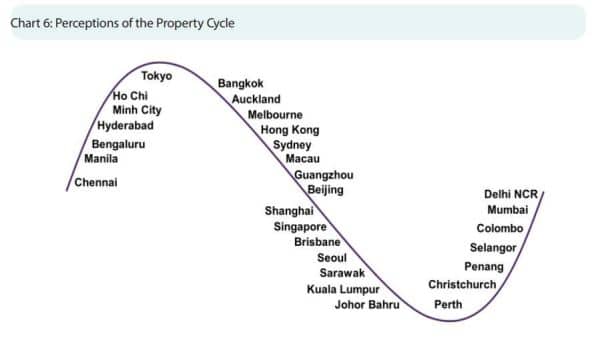

Perceptions of the Asia Pacific property cycle (image: RICS)

Perceptions of the Asia Pacific property cycle (image: RICS)

The recent protests in Hong Kong were also flagged as additional headwinds for the market.

However, some spots like Vietnam and Thailand were seen to benefit from the ongoing trade war, as companies looked to expand supply chains beyond China and into Southeast Asia.

The report showed several markets, including those in Greater China, South Korea, Australia and Singapore, were entering the later stages of the cycle.

However, RICS said those markets appeared to be “moving sideways”, where growth remained constant rather than increasing or decreasing.

In Malaysia, conditions improved compared to previous quarters, however rents and capital values are still tipped to contract over the next year.

The 2020 Tokyo Olympics has bolstered sentiment in the Japanese capital despite being seen at its peak for the past several quarters.

Confidence in several markets across India has improved after the National Democratic Alliance party was returned to power from the recent federal election.

Across Australia, Sydney and Melbourne are expected to stay positive except for retail, while confidence in Perth and Brisbane remains mixed.

In New Zealand, Auckland is seen near the peak of its cycle, while Christchurch appears to be emerging from its prolonged downturn.