Singapore-listed SPH REIT has agreed to buy a 50% stake in Adelaide’s largest shopping centre, Westfield Marion, from Australian property group Lendlease for A$670m (US$459.8m).

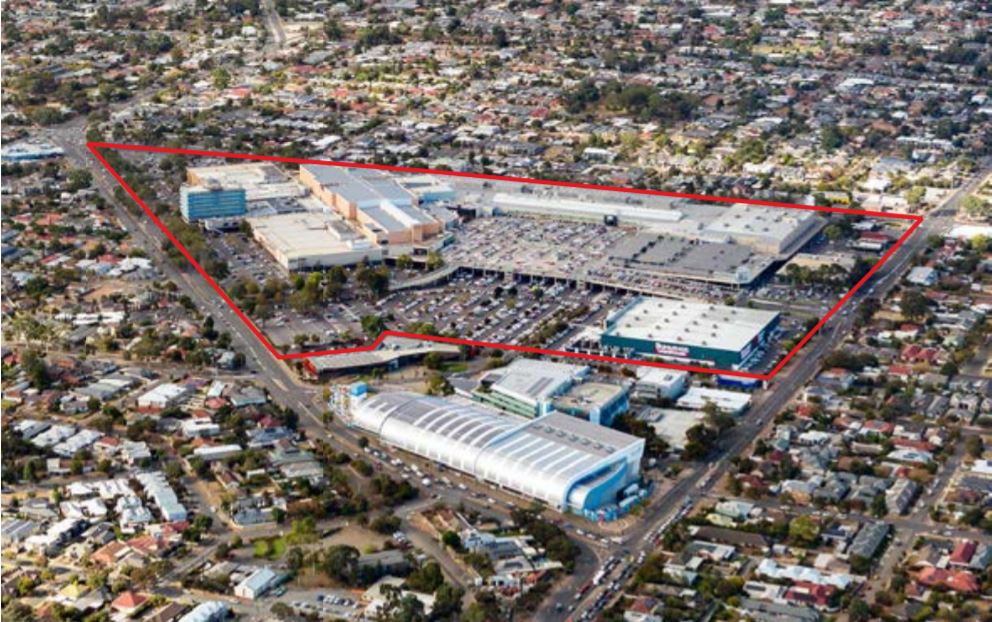

Westfield Marion

Westfield Marion

The deal follows the Singaporean retail property trust’s A$175m purchase of a majority stake in Wollongong’s Figtree Grove centre last December, its first overseas acquisition.

SPH, which has appointed Australian asset manager Moelis Australia as investment manager, will co-own the 1.5m sq.ft. asset with Australian retail REIT Scentre Group.

“Westfield Marion is the market leading Living Centre in South Australia with long-term development potential,” said Scentre Group CEO Peter Allen.

Located 10km southwest of Adelaide’s CBD, Westfield Marion has attracted an annual footfall of 13.5m visitors.

The almost fully-let property was occupied by major retailers including David Jones, Myer, Harris Scarfe, Target, Kmart and Big W, with a weighted average lease expiry of 6.7 years.

The transaction was in line with the REIT’s strategy of buying retail properties across Asia Pacific that complemented its existing portfolio.

“This transaction and our co-ownership with Scentre Group marks another significant milestone in expanding our presence in a country and sector with growth prospects,” said Susan Leng Mee Yin, CEO of SPH REIT Management, the REIT’s manager.

“The acquisition will enhance the sustainability and resilience of SPH REIT’s returns to unitholders through the increased geographic diversity, larger freehold land tenure, and longer underlying leases with embedded rental growth potential.”

The deal is expected to be completed by end of the year.

SPH REIT’s portfolio comprises the Paragon retail centre, The Clementi Mall and the Rail Mall in Singapore, as well as Figtree Grove Shopping Centre in Australia.

The REIT is managed by SPH REIT Management, which is owned by Singapore-listed Singapore Press Holdings.