You are here : Home » Insights »

The Asia Pacific real estate market had a bumper year in 2018, reaching the second highest level of deal activity in history.

It was a year dominated by blockbuster deals thanks to a record number of $500m-plus office transactions across the region.

Here are the top 10 solo property deals for Asia Pacific in 2018, as compiled by Real Capital Analytics. (Note: this list does not include portfolios, developments or forward sales.)

10. Westpac Place, Sydney

Westpac Place, Sydney (image: Mirvac)

Westpac Place, Sydney (image: Mirvac)

In June, Australian property investor Mirvac exercised its pre-emptive rights over a half share in the Westpac Place building in Sydney, buying the stake from US private equity group Blackstone for US$647.6m.

Mirvac already owned the other half of the 77,410 sq.m. office, located at 275 Kent Street and serving as the headquarters to Westpac, one of Australia’s big four banks.

9. K-Twin Towers, Seoul

K-Twin Towers, Seoul

K-Twin Towers, Seoul

Samsung SRA Asset Management snapped up the K Twin Towers office complex in Seoul for about US$664.7m in February last year.

The vendor of the 22-storey towers was a fund managed by Vestas Investment Management. However, it is understood the asset was ultimately owned by US firm KKR and Hong Kong-based investment firm LIM Advisors, which bought the asset together in 2014.

8. Taipei 101, Taipei

Taipei 101, Taipei

Taipei 101, Taipei

Japan’s Itochu Corporation completed its purchase of a 37.17% stake in the landmark Taipei 101 skyscraper from the Ting Hsin International for US$665m in July last year.

The deal made Itochu the largest stakeholder in Taiwan’s tallest building, which has 101 storeys.

7. Samsung C&T building, Seoul

City of Seoul

City of Seoul

A consortium of investors led by NH Investment Securities and Koramco REITS Management was named as the winning bidder for Samsung C&T building in Seoul in a deal worth US$671.8m.

The 81,117 sq.m. building is the headquarters of the vendor Samsung C&T, part of the South Korean multinational conglomerate Samsung Group.

6. Tokyo Service Center, Tokyo

City of Tokyo

City of Tokyo

Japanese real estate developer Mitsui Fudosan bought the former Tokyo Service Center from conglomerate Japan Post Holdings for US$778m in March last year.

5. Octa Tower, Hong Kong

Octa Tower, Hong Kong (image: Google Earth)

Octa Tower, Hong Kong (image: Google Earth)

A joint venture led CSI Properties bought the Octa Tower building in Hong Kong’s Kowloon Bay from Nan Fung Group for about US$955.6m, according to RCA.

CSI Properties reportedly partnered with CC Land and Asia Standard International Group (ASI) to buy the 64,344 sq.m. asset.

4. Centropolis Towers, Seoul

Centropolis Towers, Seoul (image: M&G Real Estate)

Centropolis Towers, Seoul (image: M&G Real Estate)

M&G Real Estate confirmed its acquisition of the Centropolis twin towers in Seoul from Korean developer CTCore for about $1.04bn in July last year.

M&G Real Estate purchased the 134,399 sq.m. asset in a joint venture with two South Korean pension funds.

3. Shiba Park, Tokyo

Shiba Park, Tokyo (image: Google)

Shiba Park, Tokyo (image: Google)

In March, the Kansai Electric Power and Tokyo Gas purchased the 14-storey Shiba Park building in central Tokyo.

RCA said the deal was worth about US$1.2bn, sold by a group of investors led by Asia Pacific Land.

2. 18 King Wah Road, Hong Kong

18 King Wah Road / North Point (image: Seth Powers/Pelli Clarke Pelli Architects)

18 King Wah Road / North Point (image: Seth Powers/Pelli Clarke Pelli Architects)

Henderson Land Development agreed to sell its North Point office complex at 18 King Wah Road in Hong Kong to China Create Capital for US$1.27bn in January last year.

The 22-storey property was newly built at the time and featured about 30,639 sq.m. of gross floor area.

1. The Center, Hong Kong

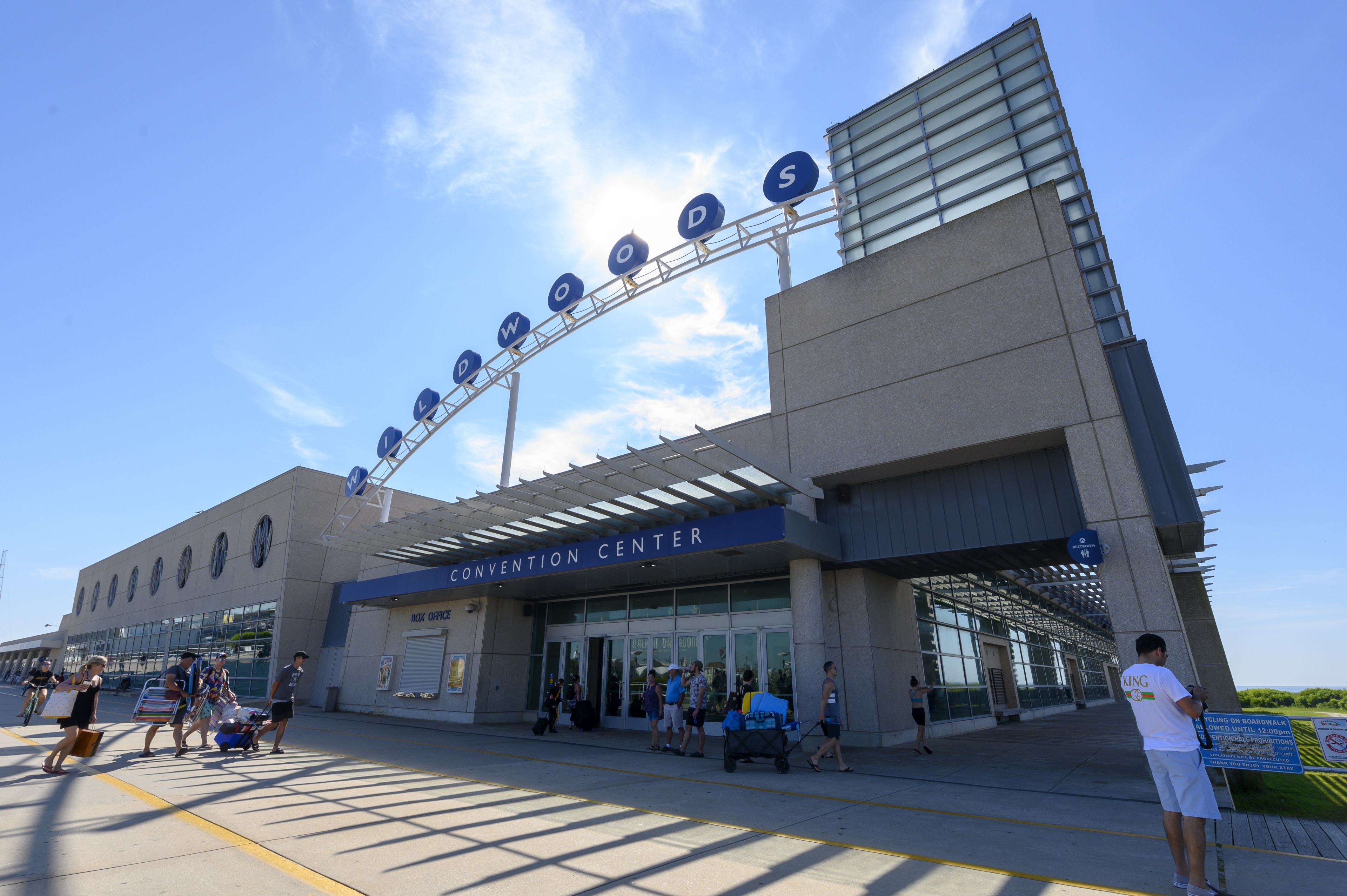

The Center, Hong Kong (image: Wildwood PR)

The Center, Hong Kong (image: Wildwood PR)

A group of investors led by tycoons Pollyanna Chu and Hui Wing Mau bought The Center skyscraper in Hong Kong from CK Asset for US$5.2bn last year.

Chu, a co-founder of Kingston Financial Group, and Hui, founder of Shimao Property Holdings, stepped in to pick up state-owned China Energy Reserve & Chemicals Group’s stake after it dropped out from the deal in early 2018.