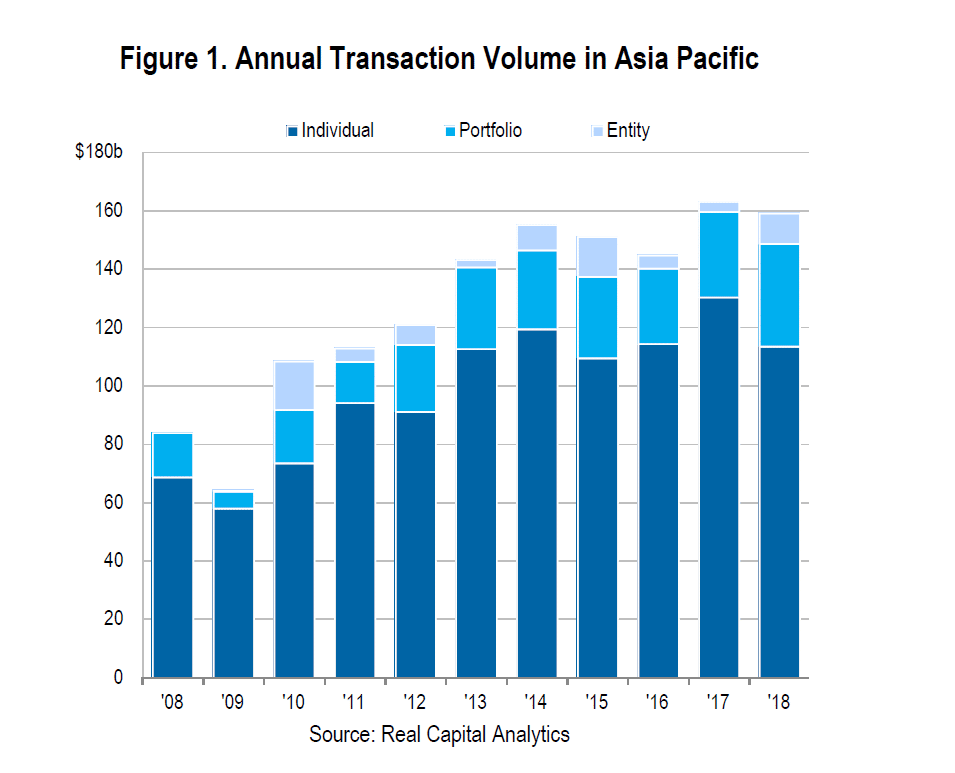

Commercial real estate investment totalled US$159.1bn across Asia Pacific in 2018, the second highest year on record, according to Real Capital Analytics.

The annual deal volume fell just 2% short of the previous record set in 2017.

“While property investment started the year strongly, activity decelerated in the second half, with investors concerned about financial market volatility and the weaker economic outlook,” said Petra Blazkova, senior director of analytics for Asia Pacific at RCA.

“But investors were also looking beyond current economic jitters at longer-term structural change in the markets and the industrial market benefitted.

“Average industrial yields dropped to around 6.0% in Asia Pacific – the lowest levels that RCA has ever recorded for this property sector.”

The industrial property sector was the clear winner last year, with transactions rising 15% year-on-year to $24.7bn.

Looking at cross-border capital flows, US investors led the way with deals such as Goldman Sachs’ participation in a joint-venture purchase of the Link REIT portfolio in Hong Kong.

Other major deals included KKR’s acquisition of DAOR E&C’s mixed-use portfolio in Seoul and Blackstone’s purchase of the Indiabulls Centre in Mumbai.

“International real estate investors from outside Asia Pacific markets, particularly US, Canadian and UK players, appeared unperturbed by the China-led slowdown in the second half and drove 2018 cross-border capital flows into the region 17% higher last year at US$27bn, to the strongest level since 2008,” Blazkova said.

UK-based investors poured $2.9bn into the region’s property markets, surpassing the previous 2007 peak.

The major deals completed by British players included M&G Real Estate’s purchase of stakes in Seoul’s Centropolis Tower and the 80 Ann Street property in Brisbane, as well as Chelsfield Group’s share in the Manulife Centre in Singapore.